who claims child on taxes with 50/50 custody

2 Can both parents claim child on taxes Canada. The custodial parent can transfer the exemption to the non-custodial parent by providing them with a signed copy of Form 8332.

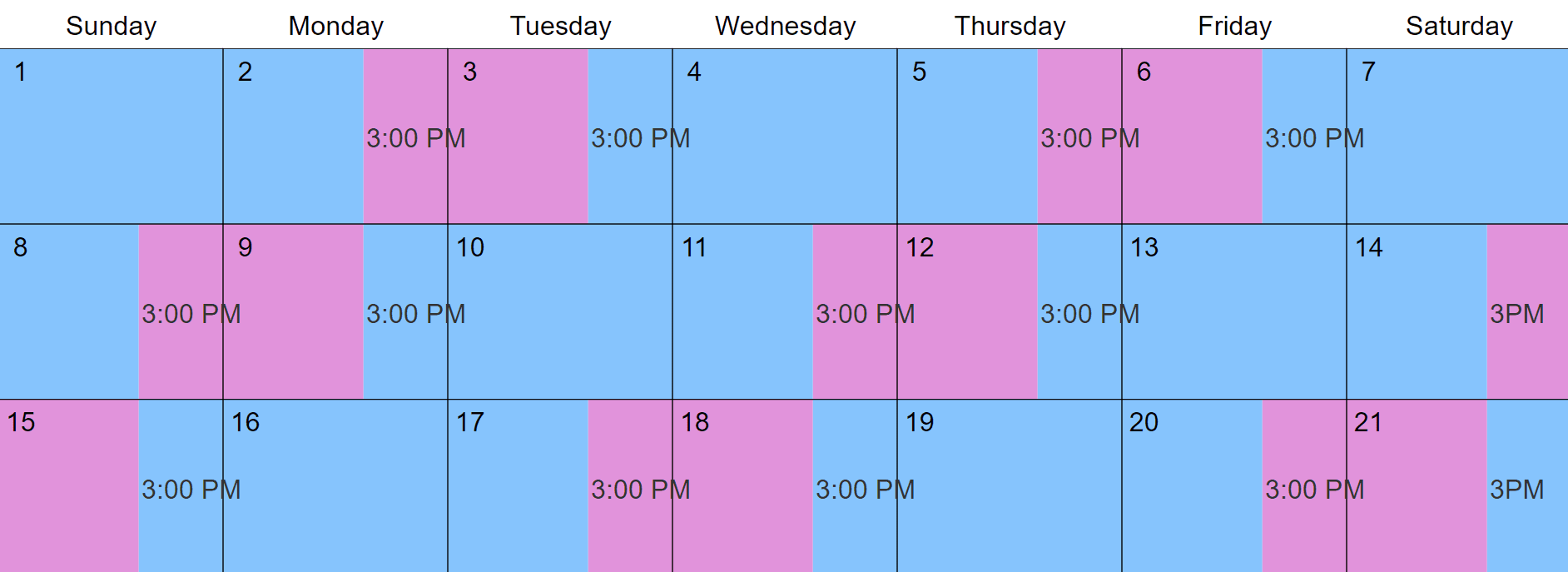

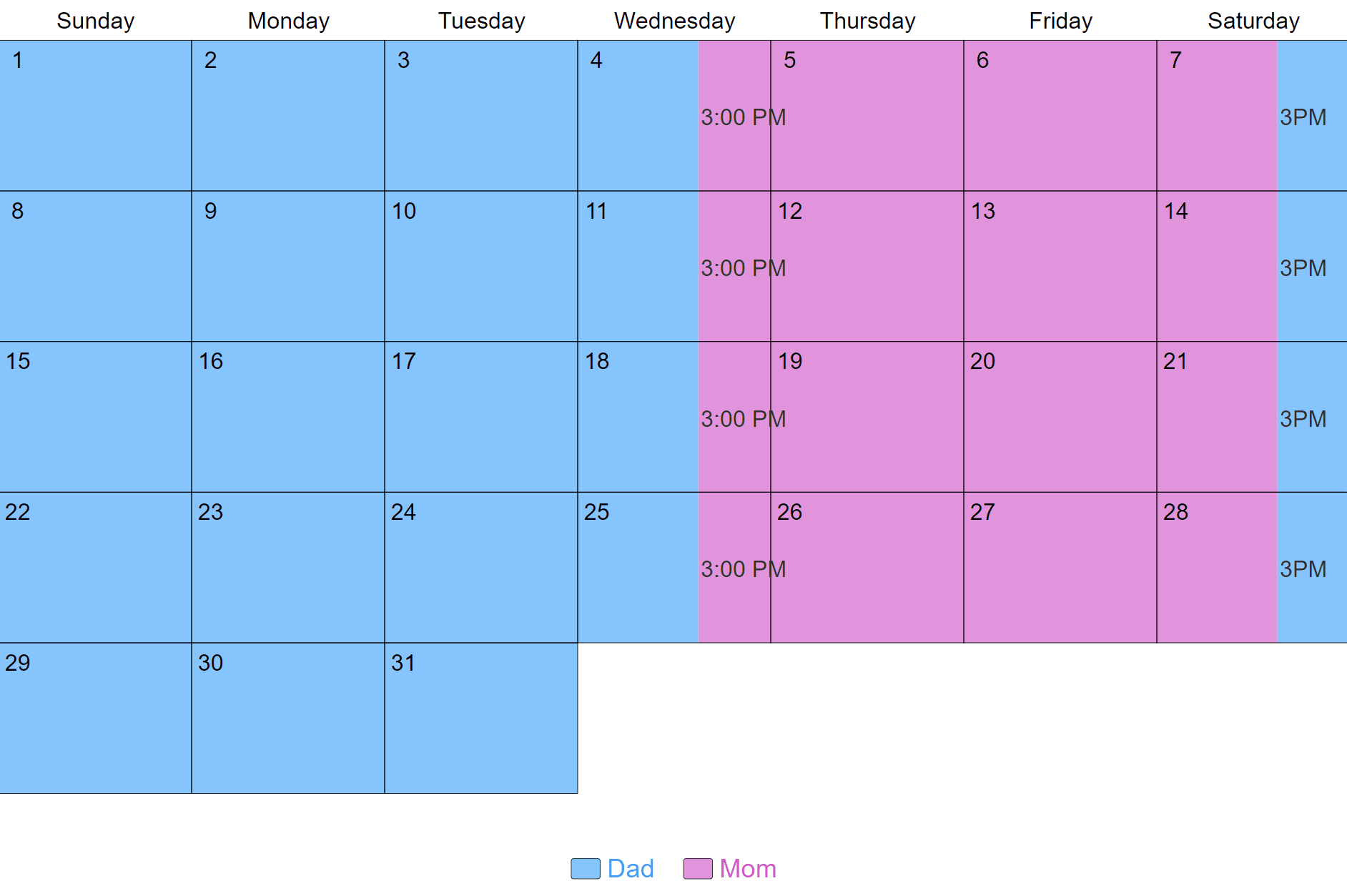

50 50 Joint Custody Schedules Sterling Law Offices S C

Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents.

. But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it. Often in the case of 5050 custody and similar financial contribution from the parents the court orders that the parents take turns in claiming for the child. 3 Is child support taxable in Ontario.

Many parents have a 50-50 custody agreement but dont have a written agreement regarding which of the parents claims the child on their taxes. The IRS explains Generally the custodial parent is the parent with whom the child lived for a longer period of time during the year. What do you say when your child wants to live with the other parent.

Iklan Tengah Artikel 2. However parents who evenly split custody have other factors to consider. Terry and Jordan agree that Terry will claim an amount for an eligible dependant on line 30400 of his.

Newer Post Older Post Home. 4 What is malicious mother syndrome. In general the parent who houses the child for most of the year is going to count as the custodial parent.

Iklan Tengah Artikel 1. Who Claims the Child With 5050 Parenting Time. Men almost never get 5050 custody because there is money to be made by the state by making it 8020 or more in favor of the mother especially if the man has a higher income.

Therefore the following questions and answers may help determine who can file their dependent. However if the child custody agreement is 5050 the IRS allows the parent with the highest income to claim the dependent deduction. However it may make the tax waters a bit murkier than they were before the divorce.

1 What age do you stop paying child support in Ontario. The Internal Revenue Service IRS typically allows the parent with whom the child lived most during the tax year to claim the child. Our firm has more Super Lawyers than any other organization in the Lone Star State.

The parent with the higher adjusted gross income AGI gets to claim the child if custody is split exactly 5050 which is technically difficult when there are 365 days in a year. If parents have 5050 parenting time but one parent contributes significantly more financials that parent may get to claim the children a greater. A 5050 custody arrangement is clearer and it is socially beneficial for both the ex-spouses and their children.

Usually the IRS allows the parent with whom the child has lived most of the tax year to claim the child. Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer Do I Have To Pay Child Support If I Share 50 50 Custody Share this post. This is true for parents without an exact 5050 custody split.

The answer lies in either your parenting time your income or your agreement with the other parent. 80 maximizes the child support order according to the formula most states use and those same states get matching federal money through title 9 of the social security act for every dollar of child. I provide more than 50 support and.

According to California law a child in 5050 child custody agreements may be considered taxable by both parents if they are jointly insured. 41 What do you say when your child wants to live with the other parent. As a result of split 5050 child custody agreements parents with high incomes can claim their children as dependent citizens.

When You Have 5050 Custody Who Claims The Child On Taxes. The Quick Guide to Dependent Tax Claims in 5050 Custody. Stimulus Checks- Joint 5050 Custody- Claiming Child Alternate Tax Years According to the IRS parents who are not married and alternate claiming of a child dependent The parent who claimed their child on their 2019 return may have received an additional Economic Impact Payment for their qualifying child.

The parent who has custody for the greater part of the year typically gets to claim the child as a dependent for tax purposes. When You Have 5050 Custody Who Claims The Child On Taxes. So one parent claims for the child one year and the other parent the next year.

The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household.

But there is no option on tax forms for 5050 or joint custody. As for custody of a child a majority of cases involve the custodial parent who jointly administers the joint custody plan. A custodial parent will often make an argument on behalf of hisher joint physical custody of their child in most cases.

Who Claims the Child if Both Parents Have Similar Incomes. So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they spend zero days per tax year with them. Jordan can claim an amount for an eligible dependant for Drew for those years since she had no obligation to pay child support and has custody of Drew.

For the 2020 tax year both parents had an obligation to pay child support to the other parent for Drew at some point during the year. Whether you have primary custody or joint custody of a child after divorce the fact remains that only one person can claim the child on each years tax forms. But who gets to claim the kids if you have joint custody.

In some cases divorced or unmarried couples work out their own arrangements such as those with multiple children dividing their children as dependents or those with only one child or an odd number of children alternating which years. For a confidential consultation with an experienced child custody lawyer in Dallas contact Orsinger Nelson Downing Anderson LLP. Understanding whether youre eligible to claim your child could potentially save you.

50 50 Custody Child Support Calculator Family Lawyer Winnipeg

Do I Have To Pay Child Support If I Share 50 50 Custody

Child Custody In Texas Who Can Claim A Child On Their Taxes

Who Claims Child On Taxes With 50 50 Custody Colorado Legal Group

50 50 Custody And Visitation Schedules Common Examples Ciyou Dixon P C

50 50 Custody Are Courts Biased Against Men Graine Mediation

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

Florida 50 50 Parenting Plan 50 50 Custody And Child Support

Is Missouri A 50 50 State For Child Custody

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

Do I Have To Pay Child Support If I Share 50 50 Custody

70 30 Custody Visitation Schedules Most Common Examples

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

Who Claims Child On Taxes With 50 50 Custody Canada Ictsd Org

4 3 Custody Visitation Schedules How Does It Work Pros Cons

Dear Parents What Your Child Really Needs This Christmas Dear Parents Parenting Apps Parenting Done Right

Who Claims A Child On Us Taxes With 50 50 Custody

Child Custody Support Deenik Lowe Llc

What Is Form 8332 Release Revocation Of Release Of Claim To Exemption For Child By Custodial Parent Turbotax Tax Tips Videos